Perspectives

Keep

Reading

3Q25 GW&K Market Insights

Macro | InsightHarold Kotler, Bill Sterling, & Dan Fasciano discuss market growth drivers, AI’s impact, policy risks, and investment opportunities in small caps, bonds, and global markets.

Read Article

GW&K Investment Review 3Q 2025

Macro | InsightDespite political uncertainty, the stock market rises, driven by falling interest rates, the AI revolution, and renewed confidence in capitalism. Hear more from GW&K’s CIO, Harold Kotler.

Read Article

When Will AI Investments Start Paying Off?

Macro | InsightGW&K's Global Strategist Bill Sterling explores risks, market concentration, and considerations for investors.

Read ArticleThis Website Uses Cookies

We use cookies to improve your experience on our website. To accept cookies click Accept & Close, or continue browsing as normal. For more information or to learn how to opt out of cookies, please see our cookie policy.

Accept and Close-

Latest Insight

3Q25 GW&K Market Insights

Macro

Harold Kotler, Bill Sterling, & Dan Fasciano discuss market growth drivers, AI’s impact, policy risks, and investment opportunities in small caps, bonds, and global markets.

Read Article -

Latest Market Commentary

State Of The States 2025 — Poised For Fiscal Stability

Municipal Bond

Fiscal conditions across state governments remain healthy as the sector heads into 2025.

Read Article

Weathering the Storm: Why Fixed Income Still Matters in Turbulent Markets

GW&K Insights | May 2025

Highlights

Introduction

The first four months of 2025 have been a wake-up call for investors accustomed to traditional portfolio dynamics. Aggressive tariff policies enacted by the Trump administration, coupled with retaliatory measures from trading partners, have fueled unprecedented market turbulence. Both equity and bond markets have experienced sharp, simultaneous price swings — a departure from the historical pattern where bonds often acted as a stabilizing force during equity market stress. This unusual correlation has shaken investor confidence in the traditional 60/40 stock/bond portfolio mix and prompted many to question whether fixed income still deserves a place in their investment strategy (Figure 1).

Despite these legitimate concerns, this article argues that fixed income remains an essential component of well-diversified portfolios, albeit with an evolved role and approach. Understanding the current volatility, evaluating relative valuations, and adopting a more nuanced fixed income strategy can help investors navigate today’s challenging market environment.

Understanding the Current Market Turmoil

The volatility we’re experiencing in 2025 stands out for both its magnitude and its unusual pattern (Figure 2). The CBOE Volatility Index (VIX), often termed the market’s “fear gauge,” reached alarming levels — briefly soaring to an intraday level of 60 — following the significant US tariff announcement on April 2. Similarly, the ICE BofA MOVE Index, which measures implied volatility in US Treasury options, hit new 12-month highs in mid-April, reflecting exceptional uncertainty in the bond market.

What makes the current situation particularly notable is the simultaneous nature of volatility spikes in both markets. Following the April tariff news, 10-year Treasury yields surged by approximately 60 basis points over five days — the most rapid increase since the Global Financial Crisis of 2008. This coordinated volatility reflects a fundamental breakdown in the traditional relationship between stocks and bonds.

The primary catalyst for this market behavior appears to be policy uncertainty.1 The abrupt implementation of broad, high tariffs and consequent retaliatory measures have created immense uncertainty regarding trade flows, corporate costs, inflation, and global growth. Additionally, President Trump’s threats to Federal Reserve independence have introduced another layer of unpredictability. These policy developments have sparked specific fears of stagflation — a combination of stagnant economic growth and persistent high inflation — which presents a uniquely challenging environment for both stocks and bonds simultaneously.2

Unlike typical recessions driven primarily by demand contraction, where bonds often benefit from a “flight to safety,” stagflationary environments can pressure both asset classes simultaneously. Tariffs inherently possess stagflationary potential, disrupting supply chains and raising import costs (inflationary) while dampening trade, investment, and consumer spending (disinflationary/ recessionary). This economic ambiguity helps explain the unusual return correlation of stocks and bonds in recent months.

The Bond Valuation Advantage

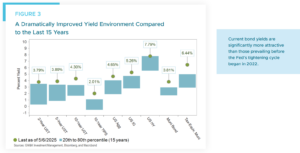

Despite the challenging environment, current bond valuations present a compelling opportunity relative to recent history. As of early May 2025, the benchmark 10-year US Treasury yield hovers around 4.3%, with investment-grade corporate bonds offering average yields near 5.3% (Figure 3). These levels, while volatile, are significantly more attractive than those prevailing before the Fed’s tightening cycle began in 2022.

Compared to the last 15 years, current yields are notably higher across key fixed income segments. For example, the Bloomberg US Aggregate Bond Index yield of 4.6% as of early May was more than double its 2.2% average over that time frame. Similar comparisons apply to US Treasuries, investment-grade (IG) bonds, high-yield (HY) bonds, and municipal bonds. This enhanced yield environment provides investors with tangible income potential that was largely absent during the preceding low-rate era.

More importantly, these higher starting yields offer a substantial cushion against potential future price declines if interest rates rise further. Unlike in early 2022, when yields were near historic lows and offered minimal income to offset price declines, today’s higher yields provide a meaningful buffer against rate volatility and credit losses. This “yield cushion” effect means that bonds can now withstand more significant interest-rate increases or credit losses before generating negative total returns (Figure 4).

The term premium — the additional yield investors demand for holding longer-term bonds compared to rolling over short-term debt — has also increased to its highest level in more than a decade (Figure 5). This suggests investors are better compensated for the uncertainty associated with longer holding periods.

Stock Vs. Bond Valuation: A Comparative Analysis

When evaluating fixed income opportunities, the relative valuation compared to equities should also be considered. By several key metrics, stocks appear expensive while bonds look increasingly attractive on a relative basis.

The Shiller Cyclically Adjusted P/E Ratio (CAPE), which compares current prices to average inflation- adjusted earnings over the previous decade, currently stands around 33 times — significantly above the long-term historical average of roughly 19 times (Figure 6). Current readings place the market in a valuation zone only surpassed during the peak of the dot-com bubble (~44) and the post-pandemic highs of 2021 (~38).

Perhaps more tellingly, the relationship between stock earnings yields and bond yields suggests a low margin of safety for stocks versus bonds. The S&P 500 earnings yield (the inverse of the CAPE ratio) currently sits at 3.0%, not far above the prevailing 10-year Treasury Inflation Protected Securities (TIPS) yield (around 2.0%). This implies that the Equity Risk Premium (ERP) — the excess return demanded for holding stocks over risk-free bonds — is relatively low (1.0%) based on this simple metric (Figure 7).

Such a compressed ERP is not extremely low, but the most notable recent precedent was a level of 1.0% seen in mid-2007 just ahead of the onset of the Global Financial Crisis. The previous extreme was a negative ERP seen around the peak of the dot-com bubble in the late 1990s. While proponents of current equity valuations might cite superior fundamentals, particularly the high growth and profitability of dominant tech firms, the historically thin margin of advantage for taking equity risk should give investors pause.

It’s worth noting that the headline S&P 500 valuation masks significant divergence within the market. Excluding the dominant “Magnificent Seven” technology stocks, the P/E ratio for the remaining 493 S&P constituents looks far more reasonable, at roughly 20x — closer to historical averages. This suggests potential opportunities in broader market segments even as the index itself appears expensive.

This valuation dichotomy — expensive broad equity indices versus the most attractive bond yields in over a decade — creates a compelling case for reexamining the relative allocation between stocks and bonds in your portfolio.

Portfolio Construction Strategies

Given the evolved landscape, how should investors approach fixed income allocations today? The key lies in adjusting expectations and adopting a more granular approach rather than abandoning bonds altogether. A key consideration for all fixed income investors is to work with active managers who will seek strong relative value across different bond sectors.

First, recognize that fixed income’s primary role has shifted somewhat from pure diversification toward income generation. The significantly higher yields now available across the fixed income spectrum provide a meaningful contribution to total returns, regardless of price movements. This income component creates value even if the negative correlation with equities remains unreliable in the near term.

Second, consider a more differentiated approach to fixed income than simply allocating to a broad market index. Various segments of the bond market offer distinct risk/return profiles suited to different objectives:

Third, consider your fixed income allocation in the context of specific economic scenarios. Under a recession scenario with controlled inflation, high-quality government bonds would likely perform well as rates fall. In contrast, a stagflationary environment would challenge both stocks and bonds, making inflation-protected securities and shorter-duration instruments relatively more attractive.

Fourth, pay careful attention to duration management. Duration measures a bond’s price sensitivity to changes in interest rates. In a volatile rate environment, simple measures of duration can be misleading, especially as embedded options come into play. It is critical to manage the underlying structure of your holdings to strike the right balance between locking in today’s higher yields and maintaining flexibility in case rates rise further.

Fifth, be strategic about tax implications3 of portfolio adjustments. In taxable accounts, municipal bonds may offer superior after-tax returns for investors in higher brackets. Additionally, the volatile environment may create tax-loss harvesting opportunities to offset gains elsewhere in your portfolio. Be mindful of the wash sale rule, which disallows the tax deduction for a loss if you acquire the same or a “substantially identical” security within a 61-day window around the sale.

Sixth, beware of the siren song of double-digit yields in bond-like products like private credit, with its own distinct risk profile that may be more equity-like during economic stress periods (see Appendix). Investments bearing such high interest rates almost certainly are associated with elevated fundamental economic and liquidity risk, even when price volatility is masked by infrequent marking to market. Such investments should probably be considered for a distinct alternative sleeve in a portfolio rather than as a simple replacement for fixed income.

Conclusion

The unprecedented market volatility of early 2025 has justifiably prompted investors to reconsider traditional portfolio construction approaches. The breakdown of the reliable negative correlation between stocks and bonds challenges long-held assumptions about diversification. However, abandoning fixed income altogether would be misguided.

Today’s fixed income market offers significantly improved income potential compared to recent years, providing a valuable return component regardless of price movements. The higher starting yields create a meaningful cushion against further volatility. Current valuations suggest bonds may offer a more favorable risk-reward proposition than equities, with the compressed equity risk premium highlighting the relative value of fixed income.

Rather than avoiding bonds, investors should adapt their approach, focusing more on income generation, adopting a more granular allocation strategy across fixed income segments, and maintaining realistic expectations about diversification benefits. In an environment defined by uncertainty, the known qualities of fixed income — reliable income, defined risk parameters, and liquidity — remain valuable portfolio attributes. The storm may be fierce, but fixed income still offers shelter for the prepared investor.

Appendix: Why Private Credit Is Not A Direct Substitute

As investors search for higher yields and apparent stability, private credit has emerged as a popular alternative to traditional fixed income. This market has expanded dramatically, from roughly $300 – $400 billion around 2010 to estimates of $1.7 – $2.5 trillion today. However, investors should approach with caution before viewing private credit as a simple replacement for the fixed income portion of their portfolios.

Private credit investments come with several significant disadvantages that traditional fixed income generally avoids. First is the fundamental illiquidity of these investments. Unlike traditional bonds that can be sold in established markets, private credit typically involves multi-year commitments with limited or no ability to exit before maturity. This sacrifices one of fixed income’s traditional advantages: providing portfolio liquidity during stress periods.

Second, private credit suffers from significant valuation opacity. While public bonds are priced continuously based on market transactions, private credit investments are typically valued quarterly using model-based approaches that involve significant subjectivity. This valuation process can artificially suppress reported volatility — a phenomenon sometimes called “volatility laundering” — which may understate the true economic risk.4

Perhaps most concerning, despite claims of enhanced protection through senior secured positions, recovery rates on defaulted private credit loans are consistently found to be lower than those for syndicated loans and high-yield bonds — approximately 33% versus 52% for syndicated loans (Figure 8).5 This suggests higher loss severity when defaults do occur.

Rather than viewing private credit as a simple high-yield alternative to traditional fixed income, investors should recognize it as fundamentally different — closer to an alternative asset class with its own distinct risk profile that may be more equity-like during economic stress periods.

William P. Sterling, Ph.D.

Global Strategist

1 While the primary catalyst for unusual volatility appears to be market uncertainty, internal market dynamics like the unwinding of leveraged positions by hedge funds also appears to have played a key role. For a good description of such factors see International Monetary Fund, “Chapter 1: Enhancing Resilience Amid Global Trade Uncertainty,” Global Financial Stability Report, April 2025.

2 See Goldman Sachs, “Why US Treasuries Sold Off When Market Volatility Jumped,” Goldman Sachs Insights, April 17, 2025.

3 GW&K is not authorized to provide tax, legal, or accounting advice. The information provided is for general informational purposes only and is not written or intended as an individualized recommendation or substitute for specific legal or tax advice, within the meaning of IRS Circular 230 or otherwise. Tax laws and regulations are complex and subject to change, which can materially impact investment results. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. Individuals are encouraged to consult with a professional tax, legal or accounting advisor regarding their specific legal or tax situation.

4 Cliff Asness, “Volatility Laundering,” AQR Perspective, January 6, 2023.

5 Fang Cai and Sharjil Haque, “Private Credit: Characteristics and Risks”, FEDS Notes, Federal Reserve Board, February 23, 2024.

William Sterling, Ph.D.

Global StrategistDisclosures

This represents the views and opinions of GW&K Investment Management and does not constitute investment advice, nor should it be considered predictive of any future market performance. Data is from what we believe to be reliable sources, but it cannot be guaranteed. Opinions expressed are subject to change. Past performance is not indicative of future results.

Indexes are not subject to fees and expenses typically associated with managed accounts or investment funds. Investments cannot be made directly in an index. Index data has been obtained from third-party data providers that GW&K believes to be reliable, but GW&K does not guarantee its accuracy, completeness or timeliness. Third-party data providers make no warranties or representations relating to the accuracy, completeness or timeliness of the data they provide and are not liable for any damages relating to this data. The third-party data may not be further redistributed or used without the relevant third-party’s consent. Sources for index data include: Bloomberg, FactSet, ICE, FTSE Russell, MSCI and Standard & Poor’s.