Perspectives

Keep

Reading

Diversification: A Reminder of the Bond Market’s Role

Wealth Insights | InsightDiversification matters: Bonds historically outperform cash in downturns, offering principal protection and steady income alongside stocks.

Read Article

Considerations For 2025 And Future Tax Years

Wealth Insights | InsightPlan smarter under the One Big Beautiful Bill Act: Melissa Jacoby shares new tax breaks and fresh strategies to protect your wealth.

Read Article

Navigating the Evolution of Private Wealth Management

Wealth Insights | InsightGW&K’s Director of Private Wealth Management, Dan Fasciano, shares his thoughts about the state of the wealth management business today and offers valuable advice for those seeking to secure their financial future.

Read ArticleThis Website Uses Cookies

We use cookies to improve your experience on our website. To accept cookies click Accept & Close, or continue browsing as normal. For more information or to learn how to opt out of cookies, please see our cookie policy.

Accept and Close-

Latest Insight

What the Federal Shutdown Means for the Economy and Markets

Macro

Global Strategist Bill Sterling takes us through how the US federal government shutdown may affect the economy and markets.

Read Article -

Latest Market Commentary

State Of The States 2025 — Poised For Fiscal Stability

Municipal Bond

Fiscal conditions across state governments remain healthy as the sector heads into 2025.

Read Article

Preparing the Next Generation for Inheritance

Building a Lasting Legacy

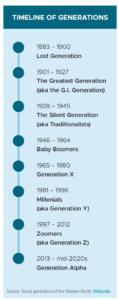

The so-called “Great Wealth Transfer” is currently underway. An estimated $124 trillion in assets will be passed down from the Silent Generation and Baby Boomers to their loved ones and charities through 2048, according to market researchers Cerulli Associates (Figure 1). What steps should those doing the transferring take to ensure their financial legacy will align with their values and goals and support their family’s long-term financial well-being?

Preparing & Planning

Successfully transferring wealth to your family requires planning, communication, and ideally the assistance of professional advisors. Passing on wealth isn’t just about legal documents and asset allocations — it’s about preparing the people who will inherit it. Without open conversations, financial education, and a clear understanding of family values and intentions, wealth transfers can go off course. When heirs aren’t ready, even the best-laid plans can lead to conflict, lost opportunities, wealth destruction, and broken family ties. True preparation goes beyond money, and builds connection, trust, and a shared sense of purpose.

It’s never too soon to begin thinking about how to prepare your children for a potential inheritance. Most parents are reluctant to discuss financial matters with their children either because they fear their own mortality or are uncomfortable with the idea of giving up control of their wealth. While this is understandable, being unprepared for when that moment eventually comes will make it even more difficult for families to deal with it. Parents who actively communicate with their children will likely reduce complications when it’s time to transfer wealth, and as a result, may avoid unnecessary taxes, costly estate settlement expenses, and potential family conflict.

Communication & Education

Communication and education are essential when developing a comprehensive plan that promotes a shared understanding of how assets will be passed to the next generation. Parents should set expectations with their children and discuss what plans are in place for the transfer of assets and why things have been set up that way. Talking to your children about your estate plan can help them manage their inheritance: A sudden windfall of financial assets could be gone quickly if your heirs have not developed money management skills before the transfer of funds. The assistance of a trusted financial advisor can help establish and implement a sound financial plan based on the needs and goals of your beneficiaries.

Passing your wealth to future generations is a big responsibility. Holding regular family meetings and maintaining consistent communication among family members was seen as an important best practice by 89% of firms surveyed by Cerulli in 2024.1 These conversations can take many forms and span years. Each family can take their own approach; however, preparing your heirs well ahead of time should be a key part of your plan. An early start to family financial education can lay the foundation for developing a productive dialogue over time. Sharing how you acquired your assets can make your children more appreciative and reduce the chances they’ll take their inheritance for granted. Parents can help their children build confidence and knowledge by gradually involving them in all areas of the family’s wealth management.

You Don’t Have to Go It Alone

GW&K advisors can assist with education on financial literacy, investment strategies, and estate planning. We encourage clients to involve us with these matters, so we can help evaluate your options and the impacts of inheritance while discussing strategies for achieving your family financial and legacy goals. Please get in touch if you’d like to start a conversation.

1 Source: “Cerulli Anticipates $124 Trillion in Wealth Will Transfer Through 2048,” December 5, 2024, https://www.cerulli.com/press-releases/cerulli-anticipates-124-trillion-in-wealth-will-transfer-through-2048.

Scott R. Peterson, CFA, CTFA, AEP

Vice President, Senior Wealth AdvisorDisclosures

GW&K is not authorized to provide tax, legal, or accounting advice. The information provided is for general informational purposes only and is not written or intended as an individualized recommendation or substitute for specific legal or tax advice, within the meaning of IRS Circular 230 or otherwise. Tax laws and regulations are complex and subject to change, which can materially impact investment results. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. Individuals are encouraged to consult with a professional tax, legal or accounting advisor regarding their specific legal or tax situation